When do I need health insurance?

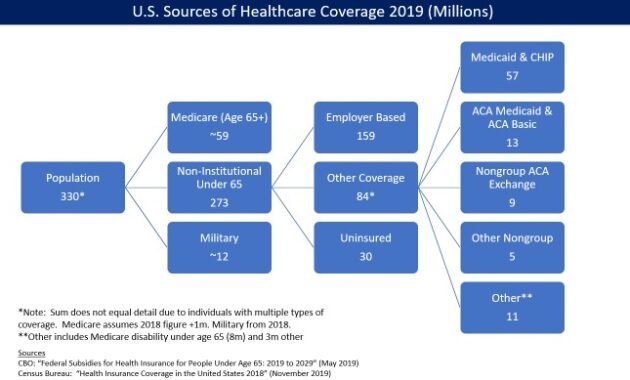

If you are not covered as a dependent under someone else’s health plan, such as a spouse/partner or parent, it’s a good idea to have health insurance. A health insurance plan can help you manage your health care needs, as well as costs.

The cost of health care without coverage can be substantial.

What are the different types of health insurance?

The different types of health insurance, include:

- Health maintenance organizations (HMOs)

- Exclusive provider organizations (EPOs)

- Point-of-service (POS) plans

- Preferred provider organizations (PPOs)

Not sure which types of health insurance are best for you? The following is a general description of each of the types of health plans.

What are health maintenance organizations (HMOs)?

HMOs give you a local network of participating doctors, hospitals, and other health care professionals and facilities that you are required to choose from. These types of health insurance plans also require you to choose a primary care provider (PCP) from the network. Your PCP is your home base for medical care. They get to know you and help coordinate all your care. They will also need to provide you with a referral to see in-network specialists. The costs for an HMO plan—copays and coinsurance– are typically lower than other types of health plans, as long as you stay in-network.

What are exclusive provider organizations (EPOs)?

An EPO offers you a network of participating providers to choose from. Most EPO plans do not include coverage for out-of-network care except in the case of an emergency. This means that if you visit a provider or facility outside the plan’s local network, you will likely have to pay the full cost of services yourself.

Depending on the plan, you may or may not be required to choose a primary care provider (PCP). If you want to see a specialist in your network, you don’t need a referral from a PCP.

What is a point of service plan (POS)?

Point of service plans combine features of HMO and PPO plans. The provider network is typically smaller than a PPO plan and the costs for in-network care are typically lower, like an HMO. POS plans also require you to choose a primary care provider (PCP) from within the plan’s network of doctors and other primary care professionals. Your PCP is your home base for care and advice. They get to know you and your health needs and can help coordinate all your care.

If you need to see a specialist, you are required to get a referral. However, like a PPO, you can also choose to see specialists that are in-network or out-of-network. If you see a doctor outside the plan’s network, your share of the costs will be higher and you’ll be responsible for filing any claims yourself.

What are preferred provider organizations (PPOs)?

PPOs typically offer you a large network of participating providers so you have a lot of doctors, hospitals, and other health care professionals and facilities to choose from. You may also choose to see providers from outside of the plan’s network, but you will pay more out-of-pocket.

Choosing a primary care provider (PCP) is not required with these types of health plans, and you can see specialists without a referral.

What types of health insurance are best for me?

Start by understanding your specific health care needs:

- If you’re in good health and don’t visit a doctor often, health insurance plans with higher deductibles typically have lower insurance premiums and could help save you money.

- If you require or expect more than just preventive care, consider plans that have lower deductibles and coinsurance, for more predictable costs.

I have a chronic condition. What types of health insurance are best for me?

Chronic conditions could require regular medication and more frequent doctor appointments, even costly hospital stays and/or surgeries. Consider a health plan that helps minimize out-of-pocket costs based on what you anticipate for doctor care, specialist visits, prescription medications, etc.

A little bit of time spent planning will help you in choosing the right types of health insurance.